1. Become an Authorized User

“One tried-and-true trick is to have someone with great credit add you as an authorized user to a card that they’ve had for a long time,” says Casey Fleming, author of The Loan Guide: How to Get the Best Possible Mortgage.

Using this method, you can piggyback off someone else’s good credit. Authorized users benefit from responsibly managed accounts because these accounts will be listed on the user’s credit report. But both you and the account holder need to be wary – if they aren’t as financially responsible as you think, or if they use their card irresponsibly, your plan can backfire and both credit scores could suffer. (Note: Authorized users can request delinquent accounts be removed from their credit reports; primary cardholders not-so-much, so be sure you’re not overcharging.)

2. Request a Credit Limit Increase

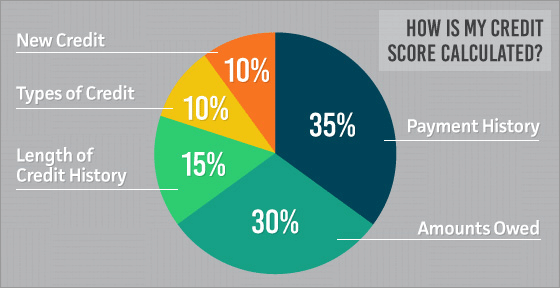

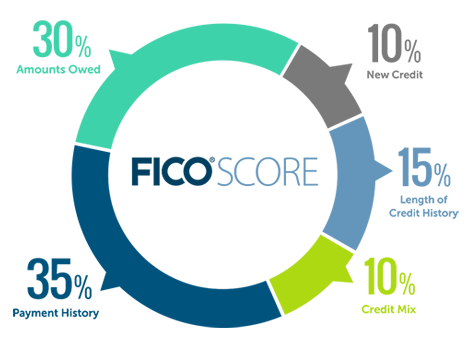

You can ask your credit card providers to increase the limits on all the cards you own. If you have a history of timely payments with your credit card provider, there’s a good chance they will negotiate. By increasing your credit limits, you’ll be improving yourcredit utilization rate, which is the amount of debt you’re carrying versus your total credit limits — and is a major contributing factor to your credit score.

Note: This will only work if you don’t increase your spending. If your credit card issuer raises your limit by $1,000, and you immediately start racking up charges that eat up the difference, the increased limit won’t do much good. Experts recommend keeping your credit card usage at no more than 30%, with an ideal balance at 10%. (You can check your credit utilization rate by viewing two of your free credit scores on Credit.com.)

Keep in mind, too, a request for a credit limit increase could result in a hard inquiry on your credit report, which can ding your credit scores, so use this strategy carefully.

3. Pay Down Your Cards

To the point above, your credit utilization rate will also improve if you pay down your credit card balances. If you have some extra funds, consider making extra payments on your credit card rather than dropping $100 at Chili’s this weekend. Doing the former can make a real difference and is a decision you’re unlikely to regret.

“Paying down your credit card balances to under 30% of the limits” will net results, says Fleming.

4. Check for Credit Report Errors

There could be an error on your credit reports that are weighing your scores down — and, is so, its removal could quickly improve your standing. You can pull your credit reports for free each year at AnnualCreditReport.com. If something is amiss, be sure to dispute it with the credit reporting agency in question. Most credit report disputes must be resolved in 30 days; a few can take up to 45 days. You can learn more about disputing errors on your credit report here.

5. Ask About Rapid Rescoring

If you’re applying for a mortgage, one lesser-known trick is to ask your lender about a rapid rescore. Rapid rescoring services are usually provided by mortgage lenders when applicants are on the cusp of qualifying for a better interest rate.

Rapid rescoring can to help update credit reports or fix errors quickly. If you recently paid off a debt, or have proof that a negative item on your credit report is inaccurate, you can provide that documentation to the lender. The lender will then request a rapid rescore on your behalf, and either absorb the cost or pass it on to you. You’ll want to ask your lender ahead of time whether you should expect charges for the service.

“If you are working with a mortgage company for a loan, they would handle this for you and it should not [drastically] mark up the costs,” says Tal Frank, president of PhysicianLoans, a niche mortgage company. “The rescore is the quickest way to see a change in your score once balances have been paid down and repairs have been made. It can be as quick as a one- or two-day turnaround time.”

http://blog.credit.com/2016/12/4-ways-to-boost-your-credit-score-164102/