Top 5 Reasons NOT To Use Lexington Law For Credit Repair

- Their process is slow. (they can take years to achieve what can be done in months).

- They are expensive (monthly payment plans seem affordable, in the long run very expensive because they are slow).

- They aren’t Credit Experts (they hire salespeople for their call center that are trained to keep you paying monthly fees).

- They don’t help build credit. (it’s important to have open credit and have access to banks that will approve you).

- They don’t have mortgage or finance background. Most people seek to improve their credit for mortgage loan or auto loan approval. Thus the need to improve the credit scores quickly.

Plenty of people expressed their dislike of Lexington Law’s service and business practices, you can read them on www.RIPOFFREPORT.com , www.PISSEDCONSUMER.com , www.BBB.org , www.GLASSDOOR.com

Jason Hall

President and Certified Credit Expert

Direct- 949.505.9971

Mobile- 808.633.5023

Fax- 866.567.8054

Holiday Shopping And Your Credit Score

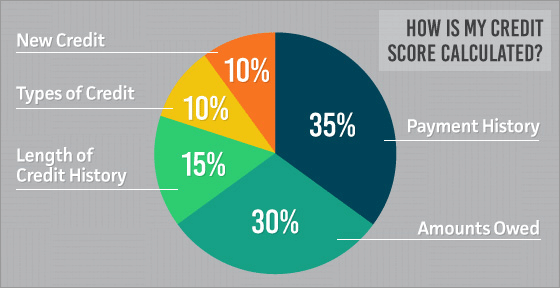

Credit scores can take a hit over the holidays if you put your purchases on your credit cards. Credit utilization composes 30% of your FICO scores, which comes only 2nd to your payment history (35% of your score).

If you carry high balances on your credit cards each month, your scores are lowered because of this. It’s best to carry no more than 10% of your credit limit on your credit cards each month for a good credit score. You can literally experience a 50-100 point score drop if you max out your credit cards, or even worse go over the credit limit.

If you find yourself in a position where you’ve maxed out your credit cards and can only make the minimum monthly payments, it would be a good idea to investigate a new “balance transfer” credit card.

These types of credit cards will offer you O% interest for 12, 18, or 21 months. This will allow you to pay down the debt much faster as all of your payment goes towards reducing the balance. If you stick with your current credit card that charges high interest, you can see only a small percent of your monthly payment going to the balance and the rest goes to interest.

For more credit, financial, or mortgage tips feel free to contact me direct Jason@RapidRescoreCredit.com

Jason Hall

President and Certified Credit Expert

Direct- 949.505.9971

Mobile- 808.633.5023

Fax- 866.567.8054